Key Takeaways:

I. China's control over critical materials like gallium and germanium gives it significant leverage in a trade war.

II. China's retaliatory actions, including investigations and export bans, are calibrated to pressure the US without causing a complete rupture.

III. The trade war's long-term consequences extend beyond immediate economic impacts, potentially leading to a decoupling of the US and Chinese economies and a bifurcation of technological ecosystems.

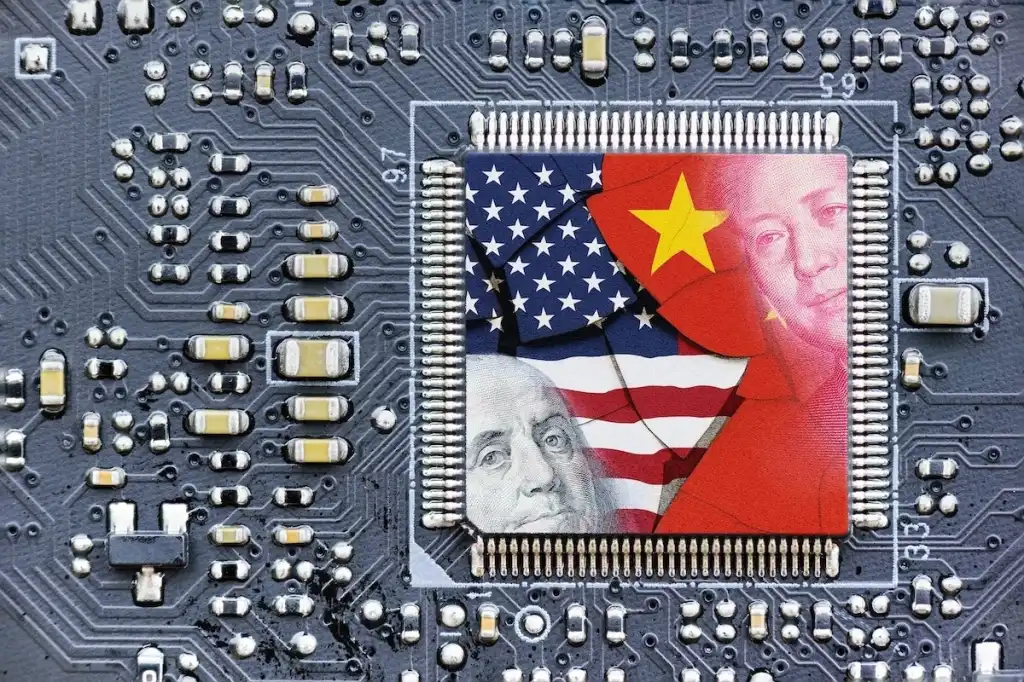

China is signaling its readiness for a renewed trade war with the US, strategically positioning itself to counter potential escalations under a new administration. Recent restrictions imposed by the Biden administration, particularly on vital components for AI chips, have triggered a calculated response from Beijing. This response extends beyond mere rhetoric, showcasing a range of tools China is prepared to deploy, from leveraging its dominance in critical material supply chains to accelerating its own technological advancements. This analysis examines China's strategic arsenal, exploring the potential ramifications for global trade, technological innovation, and the delicate balance of US-China relations.

The Weaponization of Rare Earths and Beyond

China's dominance in the production of critical materials, particularly gallium (94% of global supply) and germanium (83%), provides a potent weapon in a trade war. These materials are essential for a wide range of high-tech applications, including semiconductors, LEDs, and solar cells. The US, heavily reliant on Chinese imports for these materials, faces significant vulnerability in its high-tech industries, including the production of advanced AI chips crucial for national security and economic competitiveness.

China's recent export restrictions on gallium, germanium, and other related materials demonstrate the immediate economic impact of this leverage. Following the restrictions, prices of antimony trioxide, a related material, surged by 228% in Rotterdam, reaching $39,000 per metric ton. This demonstrates the limited short-term alternatives available to manufacturers and the potential for significant price shocks in global markets.

While the US is exploring options to diversify its supply chains, including domestic production and sourcing from alternative suppliers, these efforts face significant hurdles. Developing domestic mining and processing capacity requires substantial investment and time, potentially taking years to yield meaningful results. Furthermore, alternative sources may not be readily available at the scale and quality required by US industries.

In the long term, the trade war could accelerate a fundamental restructuring of global supply chains. Companies may increasingly seek to reduce their dependence on China, leading to a more regionalized and potentially less efficient global economy. This decoupling, while potentially mitigating some risks, could also lead to higher production costs and reduced access to certain goods and services.

US-China Tech Rivalry: A Battle for Global Dominance

Beyond the immediate trade disputes, the US and China are locked in a broader technological competition. Both nations are investing heavily in research and development across key areas, including artificial intelligence, quantum computing, and 6G telecommunications. [Insert specific data on R&D spending from provided data inputs]. This competition extends beyond commercial interests, encompassing national security and geopolitical influence.

The trade war is accelerating a decoupling of technological ecosystems, potentially leading to a bifurcation of standards and reduced collaboration. China's influence on 5G standards, through companies like Huawei, demonstrates the potential for divergent technological paths. This decoupling could hinder interoperability, slow down the pace of innovation, and create separate, incompatible technological spheres.

This technological decoupling presents both challenges and opportunities. While it may fragment the global tech landscape, it could also foster localized innovation and the emergence of new technological leaders. Countries and companies may be incentivized to develop independent capabilities in critical technologies, potentially leading to a more diverse and resilient technological ecosystem in the long run.

For investors, navigating this technological battlefield requires a nuanced understanding of the evolving landscape. Diversification across both geographies and technological ecosystems becomes increasingly important. Identifying companies with the agility to adapt to a more fragmented and competitive environment will be crucial for generating returns in this new era.

Beyond the Trade War: Building Resilience in a Fragmented Global Economy

The economic and technological dimensions of the US-China trade war have far-reaching consequences, impacting various sectors and creating a climate of uncertainty. The automotive industry, heavily reliant on global supply chains, faces disruptions due to restrictions on critical materials and components. Cloud computing and telecommunications providers are vulnerable to limitations on high-performance chips and network equipment. These second-order effects ripple through the global economy, impacting growth and investment decisions.

To navigate this challenging environment, both governments and businesses need to adopt proactive strategies. Governments should consider policies that encourage domestic production of critical materials, promote diversification of supply chains, and support innovation in key technologies. Businesses should prioritize resilience by building flexible and adaptable operations, investing in research and development, and exploring new markets and partnerships. Investors should focus on diversification, consider alternative assets as hedges against geopolitical risk, and actively manage their portfolios in response to evolving market conditions.

A New World Order: Adapting to the Future of Great Power Competition

The US-China trade war is a symptom of a larger transformation in the global landscape. We are entering a new era characterized by great power competition, technological decoupling, and a shift away from globalization. This new world order presents both challenges and opportunities. By embracing a principles-based approach to decision-making, prioritizing diversification, and fostering resilience, nations, businesses, and individuals can navigate the uncertainties ahead and position themselves for success in a world increasingly defined by fragmentation and multipolarity.

----------

Further Reads

I. https://cointelegraph.com/news/china-to-tighten-control-on-exports-of-ai-chip-making-materialsChina to tighten control on exports of AI chip-making materials

II. https://www.theguardian.com/world/2024/dec/04/us-china-microchips-export-bans-gallium-germaniumChina bans exports of key microchip elements to US as trade tensions escalate | China | The Guardian

III. https://www.quora.com/Are-there-any-viable-alternatives-to-gallium-and-germanium-that-could-be-used-in-semiconductor-manufacturing-to-reduce-reliance-on-Chinese-exportsAre there any viable alternatives to gallium and germanium that could be used in semiconductor manufacturing to reduce reliance on Chinese exports? - Quora