Key Takeaways:

I. Texas' proposed Bitcoin reserve could reshape public finance by offering a potential hedge against inflation and diversifying the state's assets.

II. Navigating the regulatory complexities and security challenges associated with digital assets is crucial for the successful implementation of a Bitcoin reserve.

III. Texas' move could accelerate Bitcoin adoption by governments and institutions, potentially influencing the future of finance and the global monetary system.

Texas lawmakers have introduced a bill proposing the establishment of a Strategic Bitcoin Reserve, a move that could position the state as a leader in cryptocurrency adoption and potentially reshape the landscape of public finance. This initiative comes amid growing concerns about inflation, the stability of the U.S. dollar, and the limitations of traditional reserve assets. The proposed reserve would allow Texas to accept Bitcoin for tax payments, fees, and donations, holding the digital asset for at least five years as a hedge against inflation and a strategic investment. This bold move raises crucial questions about the role of Bitcoin in government finance, the regulatory challenges of integrating digital assets into public treasuries, and the potential impact on the broader cryptocurrency market.

Rethinking Reserve Strategies in the Digital Age

The current macroeconomic environment, characterized by persistent inflation and the declining purchasing power of the U.S. dollar, has prompted a reassessment of traditional reserve strategies. The Consumer Price Index (CPI), a key measure of inflation, has shown a steady upward trend, reaching 2.7% in November 2024, up from 2.6% the previous month. This persistent inflationary pressure, coupled with concerns about the long-term stability of the dollar, has led to a search for alternative assets that can preserve value and hedge against inflation. Bitcoin, with its fixed supply and decentralized nature, has emerged as a potential solution, attracting the attention of governments and institutions seeking to diversify their reserves.

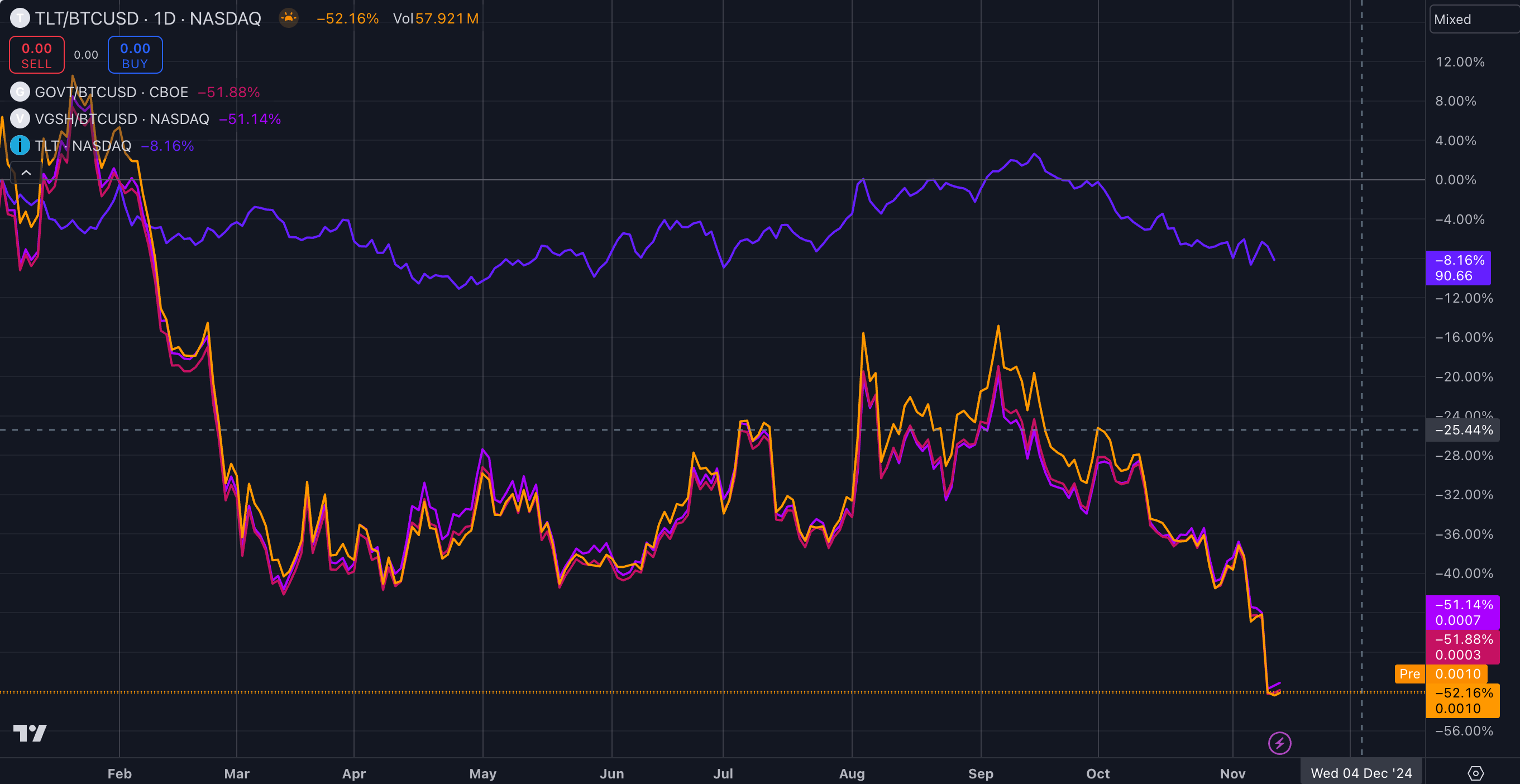

Bitcoin's unique properties as a decentralized digital asset make it a compelling alternative to traditional reserve assets like gold and U.S. Treasuries. Unlike fiat currencies, which can be printed by central banks, Bitcoin has a fixed supply of 21 million coins, making it resistant to inflationary pressures. Its decentralized nature, secured by a robust cryptographic protocol and a distributed network of nodes, makes it immune to government control or manipulation. Furthermore, Bitcoin's performance in 2024 has significantly outpaced that of traditional assets. Data from TradingView shows that US Treasury bond ETFs, such as TLT, GOVT, and VGSH, have lost over 50% of their value against Bitcoin year-to-date, highlighting the potential opportunity cost of holding traditional fixed-income securities.

As a reserve asset, Bitcoin offers several potential benefits. Its scarcity and resistance to inflation make it a potential hedge against the devaluation of fiat currencies. Furthermore, its relatively low correlation with traditional asset classes enhances portfolio diversification, potentially mitigating systemic risks. While Bitcoin's price is known for its volatility, this volatility can also present opportunities for significant gains. Its historical compound annual growth rate (CAGR), despite fluctuations, has significantly outpaced that of gold and the U.S. dollar, suggesting a superior long-term growth potential. This combination of potential inflation hedging, diversification benefits, and growth potential makes Bitcoin an attractive option for forward-thinking governments seeking to enhance their financial resilience.

However, integrating Bitcoin into a state's financial reserves also presents challenges. The volatility of Bitcoin's price, while potentially offering substantial gains, also introduces significant downside risks. Managing this volatility requires sophisticated risk management strategies and a deep understanding of the cryptocurrency market. Furthermore, the regulatory landscape surrounding digital assets is still evolving, creating uncertainty and necessitating careful navigation of legal and compliance requirements. Finally, the environmental impact of Bitcoin mining, though increasingly mitigated by renewable energy sources and technological advancements, remains a valid concern that requires ongoing attention and innovative solutions.

Regulatory and Tax Implications of a State-Held Bitcoin Reserve

The regulatory landscape for digital assets is in constant flux, creating a complex and evolving environment for governments exploring Bitcoin reserves. While the White House has released a framework for regulating digital assets, its implementation at the state level remains unclear. Texas' existing digital asset laws, such as the Revised Uniform Fiduciary Access to Digital Assets Act (Chapter 2001 of the Estates Code), provide a starting point but lack the specific provisions needed to comprehensively govern a state-held Bitcoin reserve. This regulatory uncertainty necessitates a cautious, adaptive approach, requiring policymakers to anticipate and respond to evolving legal and compliance requirements.

The fiscal implications of a state-held Bitcoin reserve are equally complex. The IRS requires reporting of cryptocurrency transactions, but the specific tax treatment of Bitcoin held as a reserve asset is not explicitly defined. Questions surrounding potential capital gains taxes upon the sale or disposition of Bitcoin from the reserve, as well as the potential for tax deductions related to acquisition and security costs, require clarification. This lack of clear guidance creates challenges for budgeting, reporting, and ensuring transparency in public finances, necessitating collaboration between state and federal tax authorities to establish a clear and consistent framework.

Beyond tax implications, significant legal challenges exist regarding the custody and security of a state-held Bitcoin reserve. The absence of established legal precedent raises questions about the appropriate custodial arrangements, security protocols, and compliance with anti-money laundering (AML) and know-your-customer (KYC) regulations. The selection of a qualified custodian with proven expertise in digital asset security is paramount, as is the implementation of robust internal controls, regular security audits, and penetration testing to identify and address potential vulnerabilities.

Integrating Bitcoin into existing financial systems presents practical challenges. The lack of seamless interoperability between traditional banking infrastructure and cryptocurrency networks necessitates the development of specialized solutions for managing and transacting with Bitcoin holdings. The volatility of Bitcoin's price also introduces complexities in valuation and accounting, potentially requiring the adoption of new methodologies and reporting standards. Addressing these operational and technical challenges is crucial for the efficient and transparent functioning of a Bitcoin reserve, requiring careful planning and investment in appropriate infrastructure and expertise.

A Catalyst for Change: Texas and the Evolution of Global Finance

Texas' adoption of Bitcoin as a reserve asset, while a state-level initiative, carries significant global implications. If successful and emulated by other jurisdictions, this move could signal a decline in confidence in the U.S. dollar as the world's dominant reserve currency. This shift could accelerate the trend towards a more multipolar currency system, with various currencies, including digital assets like Bitcoin, competing for dominance. Such a transition, while potentially destabilizing in the short term, could ultimately foster greater financial diversity and resilience in the global economy.

The long-term consequences of this shift are far-reaching and uncertain. A decline in the dollar's dominance could diminish U.S. influence in global affairs, potentially reshaping geopolitical alliances and trade relationships. The rise of decentralized currencies like Bitcoin could challenge the established authority of central banks and international financial institutions, leading to a fundamental restructuring of the global financial architecture. Navigating this evolving landscape requires careful monitoring, analysis, and a willingness to adapt to a rapidly changing world order. The Texas Bitcoin experiment could serve as a valuable case study, providing insights into the challenges and opportunities of integrating digital assets into public finance on a global scale.

A Calculated Risk: Texas' Bitcoin Strategy and the Future of Finance

Texas' decision to explore Bitcoin as a reserve asset represents a bold and potentially transformative step in the evolution of public finance. The potential benefits of Bitcoin – inflation hedging, portfolio diversification, and long-term growth potential – are enticing, but the challenges are equally substantial. Navigating the complex regulatory landscape, managing the volatility of Bitcoin's price, ensuring the security of digital assets, and addressing the environmental impact of Bitcoin mining are all crucial for the long-term success of this initiative. The Texas experiment will be closely watched by governments, institutions, and investors worldwide, as its outcome could significantly influence the future of finance and the global monetary system. This is not merely a regional policy decision; it is a calculated risk with the potential to reshape the very foundations of public finance in the digital age.

----------

Further Reads

I. https://www.longtermtrends.net/bitcoin-vs-gold/Bitcoin vs. Gold - Updated Chart | Longtermtrends

II. https://www.longtermtrends.net/gold-vs-real-yields/Gold vs. Real Yields - Updated Chart | Longtermtrends

III. https://cointelegraph.com/learn/articles/proposed-us-bitcoin-strategic-reserveThe proposed US Bitcoin strategic reserve, explained